At the moment, there are no entries available for display

With an investment record spanning well over 40 years, Kingdom Holding Company (KHC) is widely acknowledged to be a formidable force in the global equity landscape. KHC’s investment philosophy is built on one foundational principle: judicious diversification, with a strategy focused on building a vibrant, high-performing portfolio designed to create long-term value to all stakeholders.

Our portfolio can be categorised into three main business lines: equity investments, hospitality, and real estate. Through these ventures, we seek to maximise shareholder value and drive sustainable growth while facilitating the advancement of their respective industries. KHC also plays a critical role in driving the ongoing transformation of Saudi Arabia and its rapidly growing economy, in full alignment with the Vision 2030 agenda and contributing in no small part to job creation, diversification, and the expansion of an increasingly dominant private sector.

Our investment strategy aims to balance stable, revenue-generating assets with exposure to high-growth industries. Our teams take great pains to identify and capitalise on emerging, future-oriented opportunities in both domestic and international markets, ensuring a predictable dividend stream and leaving our shareholders assured of our commitments to them. Though our share price performance has been sluggish, the public equity element of the portfolio carries higher valuation than the group as a whole, positioning KHC as a value play based solely on asset valuations.

Over the years, our portfolio has served to increase the Company’s strategic foothold in a number of industries that promise high returns, across the three main business lines, as follows:

Equity

Equity holdings account for 43.3% of our portfolio, with significant interests in some of the world's most recognisable brands. Perhaps the most important and most focused of our asset classes, the equity segment accounts for our influential presence in such high-growth sectors as technology, aviation, education, healthcare, digital media, e-commerce, and finance, among others, both in Saudi Arabia and abroad.

Hospitality

Our hospitality segment, which makes up 30.8% of our holdings, continues to see rapid growth, continuing to position KHC as a leader in the industry, with ownership and management stakes in world class properties and hotel chains in the Kingdom and around the world. The hospitality portfolio also plays a vital role in helping Vision 2030 achieve its tourism development goals.

Real-estate

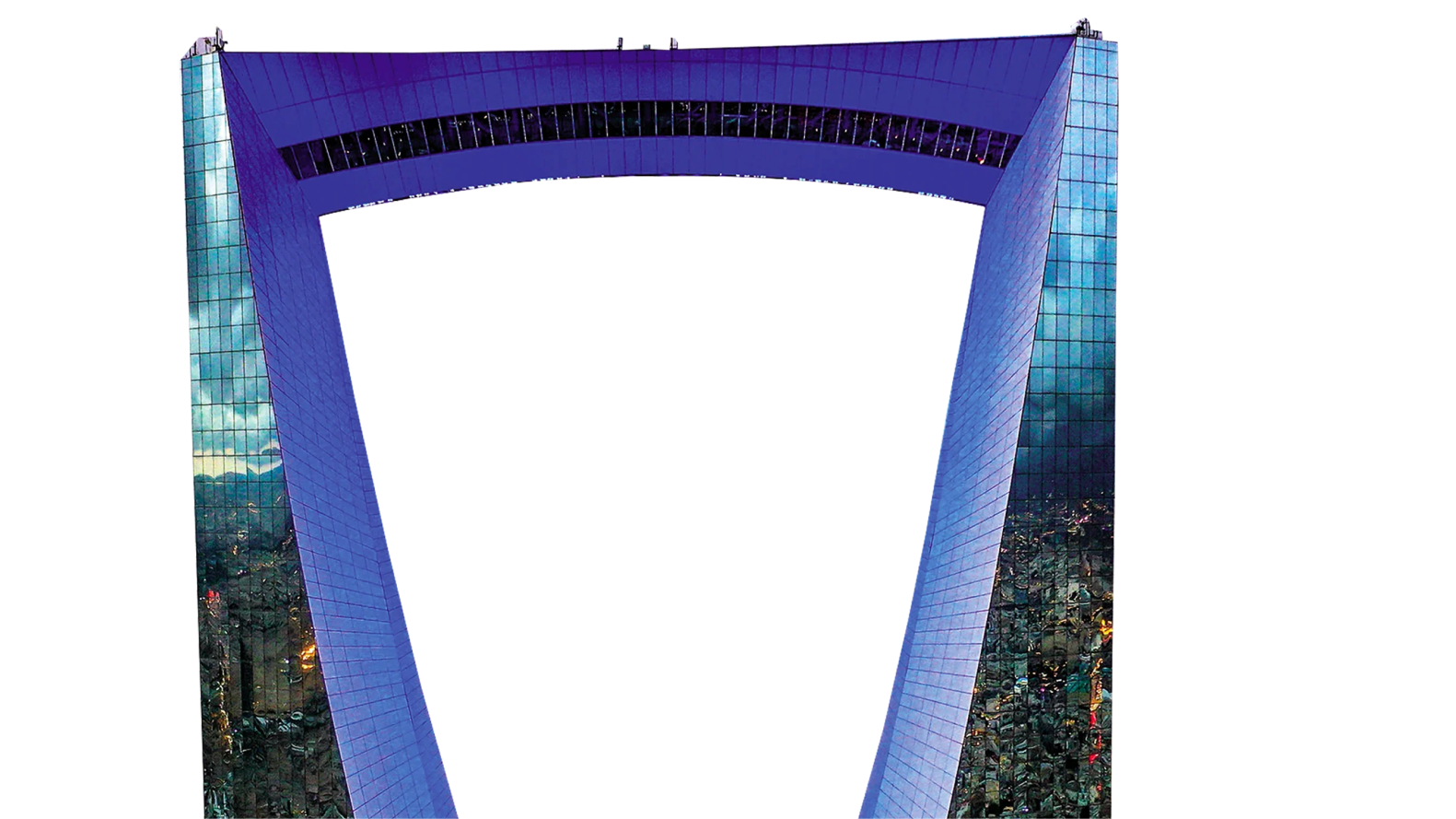

Contributing to 25.9% of our investments, the real-estate segment boasts such icons as the Kingdom Tower in Riyadh and a host of other landmark mixeduse projects that have come to define our cityscapes. The eagerly awaited Jeddah Tower, situated in the Jeddah Economic City, a KHC development, will soon be the tallest building in the world and is projected to enhancing the valuation of the surrounding land parcels, while also boosting the Kingdom's image

ESG focus

Sustainability and integrating environmental, social, and governance (ESG) principles across our business lines will be a priority as we move forward on our growth trajectory. We have already launched initiatives to reduce carbon emissions across our hospitality and real estate assets, while supporting local communities by providing employment to many.

A growth mindset

As global macroeconomic headwinds continue to induce volatility in markets, KHC’s approach to growth is more than vindicated, showcasing exceptional resilience in navigating challenges. Our investment strategy, designed to withstand the direst of external circumstances, has over the past several decades ensured sustained performance through prudent asset allocation and a future-focused outlook.

More recently, KHC has taken decisive measures to expand into artificial intelligence (AI) and enter new markets in North America and Europe. Plans are underway to expand into unlisted assets such as startups in technology and biotech and investments in giga-projects such as NEOM and the Red Sea Development as well. KHC is also exploring possibilities in the growing renewable energy sector, in increased alignment with Vision 2030. Even as we look toward further diversification, we are also strategically divesting assets that do not meet performance expectations. The recent exit of USD 1.5 Bn. in mature assets, for instance, has allowed us to reallocate capital to more promising ventures. We hare also keeping a close watch on sectors that are benefitting from ongoing demographic shifts and digital transformations, anticipating steady growth underpinned by strategic investments and a favourable economic environment.

As we move beyond 2025, KHC remains perfectly positioned to capitalise on the transformative investment opportunities that come our way, as we advance our Saudi investment strategy and expand our footprint in emerging markets, particularly in the Asia-Pacific and MENA regions.