At the moment, there are no entries available for display

KHC continued to invest according to its strategic objectives in 2024, with new investments and developments including:

Strategic investments and portfolio adjustments

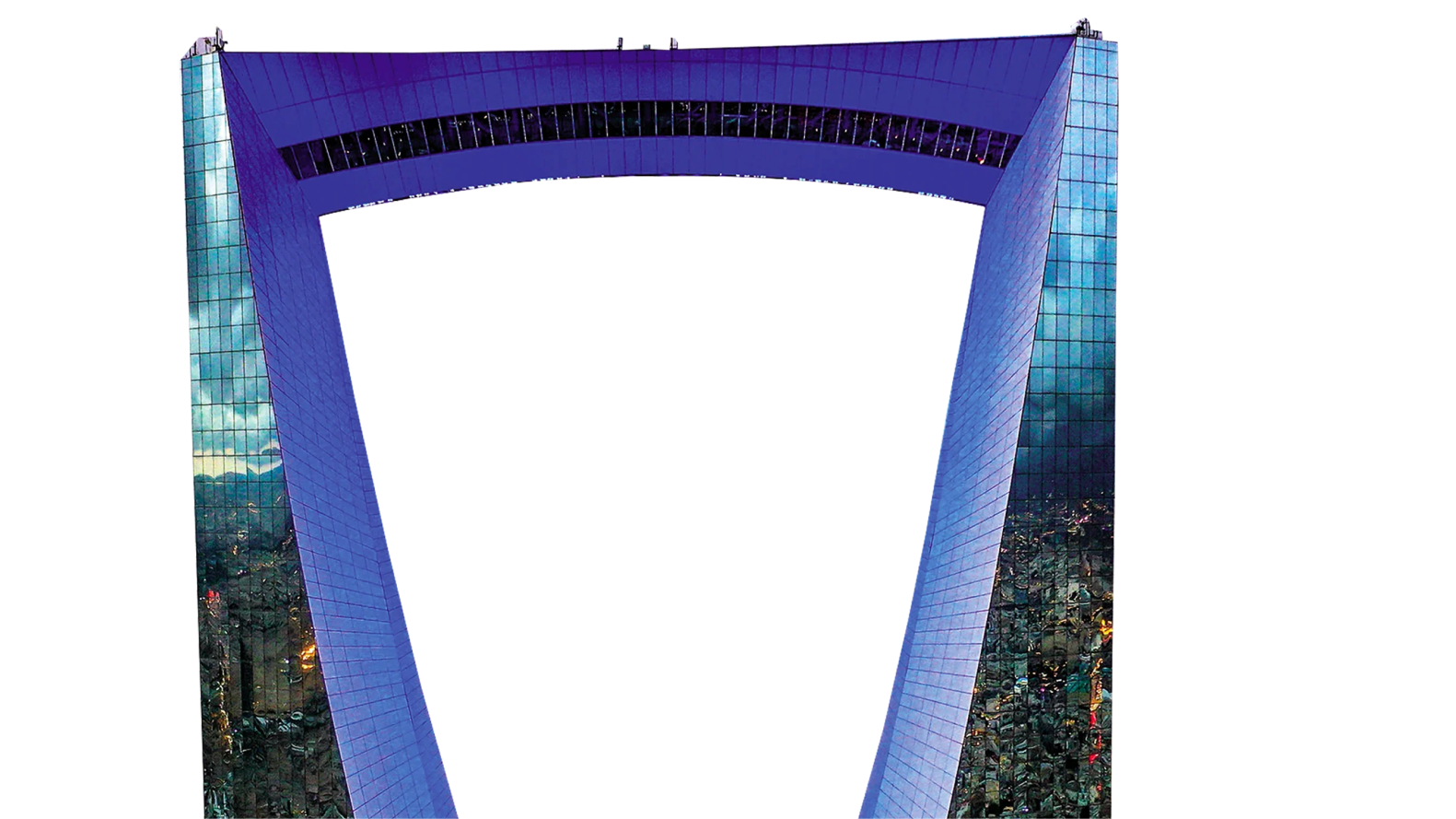

- KHC’s investment in The Jeddah Economic Company Tower, set to become the world’s tallest structure at over 1,000 meters, with 63 of its eventual 157 floors now completed. This landmark will form part of the development’s first phase, spanning 1.3 million square meters out of the broader 5.3 million-square-meter Jeddah Economic Company City. Infrastructure for this initial phase, encompassing electricity, water, sewage, flood drainage, and high-speed internet, has already been put in place.

- Kingdom Holding Company (KHC) invested USD 800,000,000 (Series B and Series C) in xAI, which is now valued at USD 1,120,000,000 based on the latest funding round (Series C). This move further strengthens strategic partnerships with Elon Musk. It also builds on KHC’s long-standing stake in X (Twitter), held since 2015.

Key financial performance and profitability

- KHC reported a net profit of X 1,237 Mn., marking a 22% YoY increase. The growth was primarily driven by reduced financing costs, a X 224 Mn. deferred tax income on Four Seasons, the X 200 Mn. reversal of NAS impairment provision, and the sale of Kingdom Compound.

- Debt reduction efforts led to a decrease in financing costs by X 346 Mn., achieved through debt repayments, interest rate cuts, and refinancing initiatives. This was supported by proceeds from asset sales, including the monetization of select commercial properties.

- Dividend income declined YoY due to the sell-down of stakes in Telefonica, Citi, BHP, and Rio Tinto, though partially offset by dividends from new investments in Alibaba, Meta, and Hercules Capital.

Overall, in 2024, KHC strived to balance financial strength with strategic recalibration, optimizing the Company’s holdings and capitalizing on key investment opportunities.

The hospitality sector in particular stood out in 2024, delivering strong results, with Accor and Four Seasons outperforming expectations and contributing meaningfully to overall profitability. Earnings from George V and Savoy did not perform the best compared to previous year but maintained stability. KHC also executed a measured restructuring of its X 30.1 Bn. equity portfolio, strategically paring back exposure to select international assets while expanding its footprint in high-growth sectors such as artificial intelligence (AI) and digital media.

With a more sharpened portfolio and a reaffirmed commitment to long-term value creation, we are well-positioned to leverage global market shifts while continuing to play a central role in Saudi Arabia’s economic transformation under Vision 2030.