At the moment, there are no entries available for display

Kingdom Holding Company’s strategic investments represent the company’s core and most pivotal ventures both in Saudi Arabia and globally. As a deeply involved investor, KHC’s present and long-term success and expansion are intrinsically connected to these holdings.

Flynas

flynas, the leading low-cost airline in the Middle East, delivered record performance in 2024, serving over 14.7 million passengers, a 32% increase from 2023.

The airline’s fleet currently contains 61 aircrafts with a commitment to upscaling its fleet by adding 157 aircrafts in the near future. flynas further increased its operations by adding 16 new routes and boasting a 22% increase in seat capacity on domestic and international flights.

flynas is gearing up for IPO to be carried out in 2025, resulting in the company being listed on the Saudi Stock Exchange.

stake in flynas, an investment which aligns with the Kingdom’s Vision 2030

4 A320ceo crafts

4 wide-body A330 crafts

Total of 61 aircrafts

X and xAI

For the full year 2024, X delivered robust financial performance and received its latest funding round in Q1 2025 at a slightly higher valuation, after acquisition which was USD 44 Bn.

In parallel, XAI, the advanced artificial intelligence division, achieved significant growth in 2024. These milestones, alongside the company’s reorganization into five streamlined business units, underscores a commitment to long-term sustenance and profitability. XAI received its latest funding round (Series C) and attained a pre-money valuation of USD 45 Bn. and post-money valuation of USD 51 Bn.

Supported by major shareholders, these strategic efforts position the group for sustainable, long-term expansion in the global market.

Citi

Throughout 2024, Citi delivered strong financial performance, reporting net income of USD 12.7 Bn. on revenues of USD 81.1 Bn. compared to net income of USD 9.2 Bn. on revenues of USD 78.0 Bn. in 2023.

The re-structuring which began in 2023 has continued in 2024 as well, simplifying how the company is run and increase its efficiency. This is a process with KHC, a major shareholder since 1991, supports wholeheartedly.

1.06% stake

USD 81.1 Bn.

USD 51.44

at 31 December 2023 to

USD 70.39

by 31 December 2024

Four Seasons

Four Seasons, one of the world’s most prestigious hotel management companies, has been privately held by Kingdom Holding Company and Cascade Investment Management since 2007. With KHC’s involvement dating back to 1994, Four Seasons has evolved from a modest motoring inn founded in Toronto in 1961 into an iconic global brand. Today, it operates 132 luxury hotels & resorts and 55 residential properties in 47 countries.

growth in revenue in 2024

USD 10 Bn. - X37.5 Bn.

on the development of Four Seasons Resort Red Sea

Jeddah Economic Company

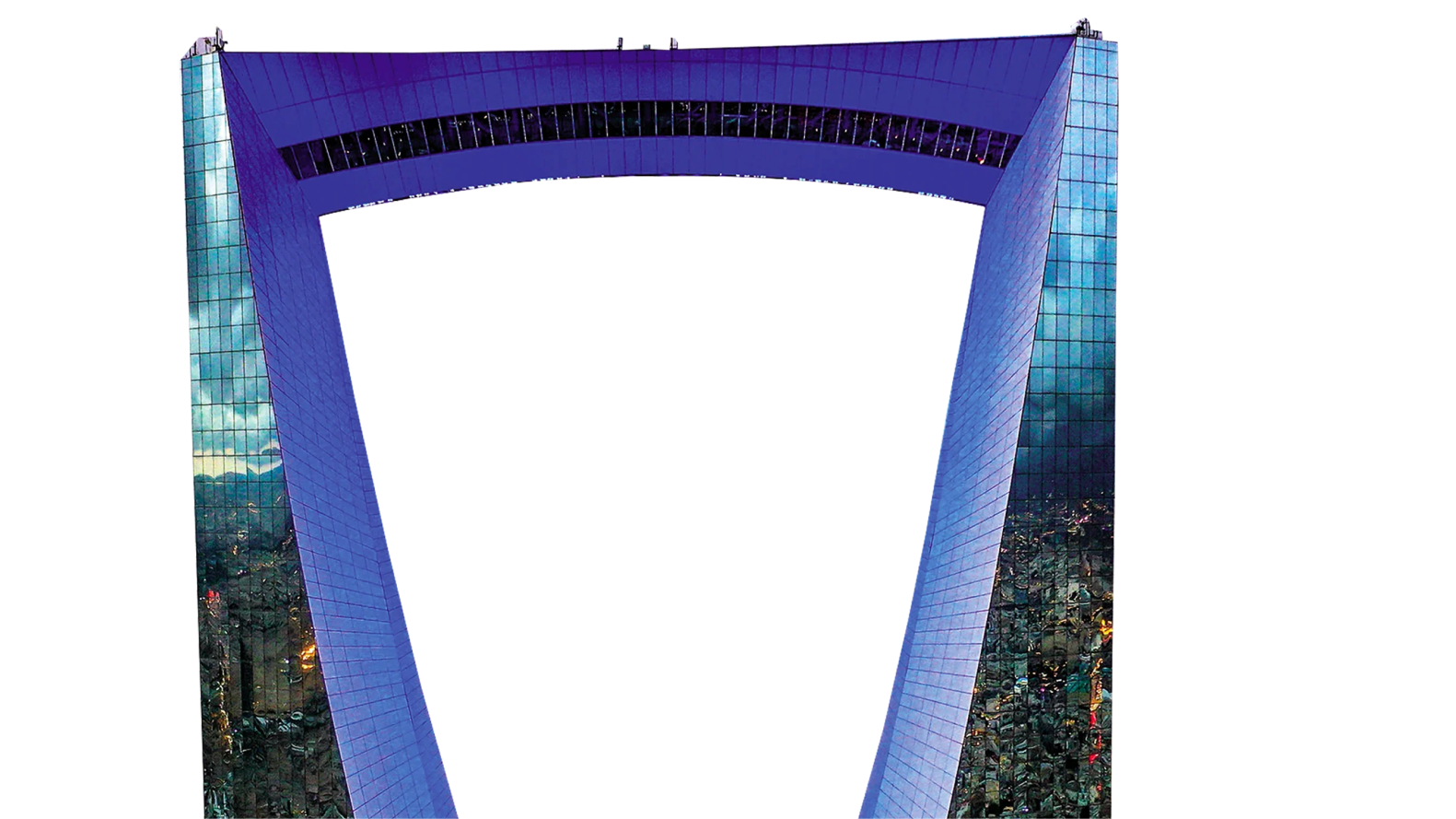

Jeddah Economic Company (JEC) was established in 2009 to develop a 5.3 million m² urban mixed-use destination in North Obhur, Jeddah, centred around the iconic Jeddah Tower, set to be the world’s tallest building at over 1,000+ meters.

A joint venture among Kingdom Holding Company, Abrar Holding Company, Qila’a Jeddah Company, and The Saudi Bin Ladin Group, JEC aims to transform Jeddah into a vibrant, globally recognized metropolis aligned with Saudi Vision 2030.

5.3 million m2

of land for an urban mixed-used destination

BSF

In 2024, BSF achieved a 7.6% increase in net income to X 4.54 Bn. The bank’s total assets reached X 292.8 Bn. In 2024, BSF continued its forward momentum by deepening its digital capabilities and further diversifying its product offerings. The bank introduced innovative services aimed at enhancing customer experience and operational efficiency. This approach not only allowed BSF to strengthen its market position but also positioned the bank to meet emerging demands and capture new opportunities across the Kingdom of Saudi Arabia’s evolving financial landscape.

net income

assets in 2024

ACCOR

In 2024, Accor accelerated its growth trajectory, reinforcing its position as a global hospitality leader. The group expanded its lifestyle and luxury portfolio across strategic international markets, with a particular emphasis on the Middle East and Asia-Pacific; regions key to its long-term vision. Building on the strategic realignment initiated in the previous year, Accor launched advanced digital booking platforms and expanded its suite of contactless guest services, further enhancing both the guest experience and operational agility. These initiatives enabled Accor to respond to the growing demand for personalized, immersive stays, while strengthening its ability to capitalize on emerging opportunities in a dynamic and fast-evolving travel landscape.