At the moment, there are no entries available for display

Founded in 1980, Kingdom Holding Company is one of the world’s foremost diversified investment holders. The Saudi conglomerate manages a globally diversified portfolio and is widely recognised for delivering continuous and sustainable growth while maximizing long-term shareholder value.

Under the leadership of founder chairman HRH Prince AlWaleed Bin Talal Al Saud, KHC operates as a single investment committee with a unified team and a strategy characterized by long-term, patient capital deployment and active engagement with portfolio companies to maximize performance and drive sustainable returns.

A fully homegrown entity, KHC takes pride in the decisive role it plays in promoting Saudi Arabia’s growth agenda while simultaneously expanding its global foothold, anchored by strategic objectives that align with the Kingdom’s ambitious Vision 2030 initiative and its wider diversification goals.

KHC’s investment portfolio is categorised into three primary business lines: equity investments, hospitality, and real estate, which together comprise a domestic portfolio and an international portfolio of holdings valued at X 71.3 Bn. or USD 19 Bn., capitalising on unique growth opportunities. Equity holdings include established blue-chip companies with solid growth prospects among others, while the hospitality segment includes some of the world’s most recognisable hotel brands. Our real estate portfolio, meanwhile, covers a total land area of 9.6 million square metres.

Our international portfolio is global in scope, covering high-growth market segments as diverse as ride-sharing, e-commerce, digital services, social media, and artificial intelligence, with stakes in leading companies such as Lyft, Uber, X (formerly Twitter), and xAI. KHC also maintains significant investments in banking and financial services (Citigroup, Saudi Fransi Bank), aviation (flynas), education (Kingdom Schools Company), petrochemicals (Tasnee), and real estate (Jeddah Economic City, Kingdom Centre, Kingdom City, and Land Bank).

Going into 2025, KHC remains a global leader in luxury hospitality, with ownership and management interests in iconic properties such as the George V in Paris and the Savoy Hotel in London. Its portfolio includes world-renowned hotel chains like Four Seasons and Accor Group, the latter of which owns over 40 popular brands including Fairmont, Raffles, Movenpick, Swissotel, Sofitel and others.

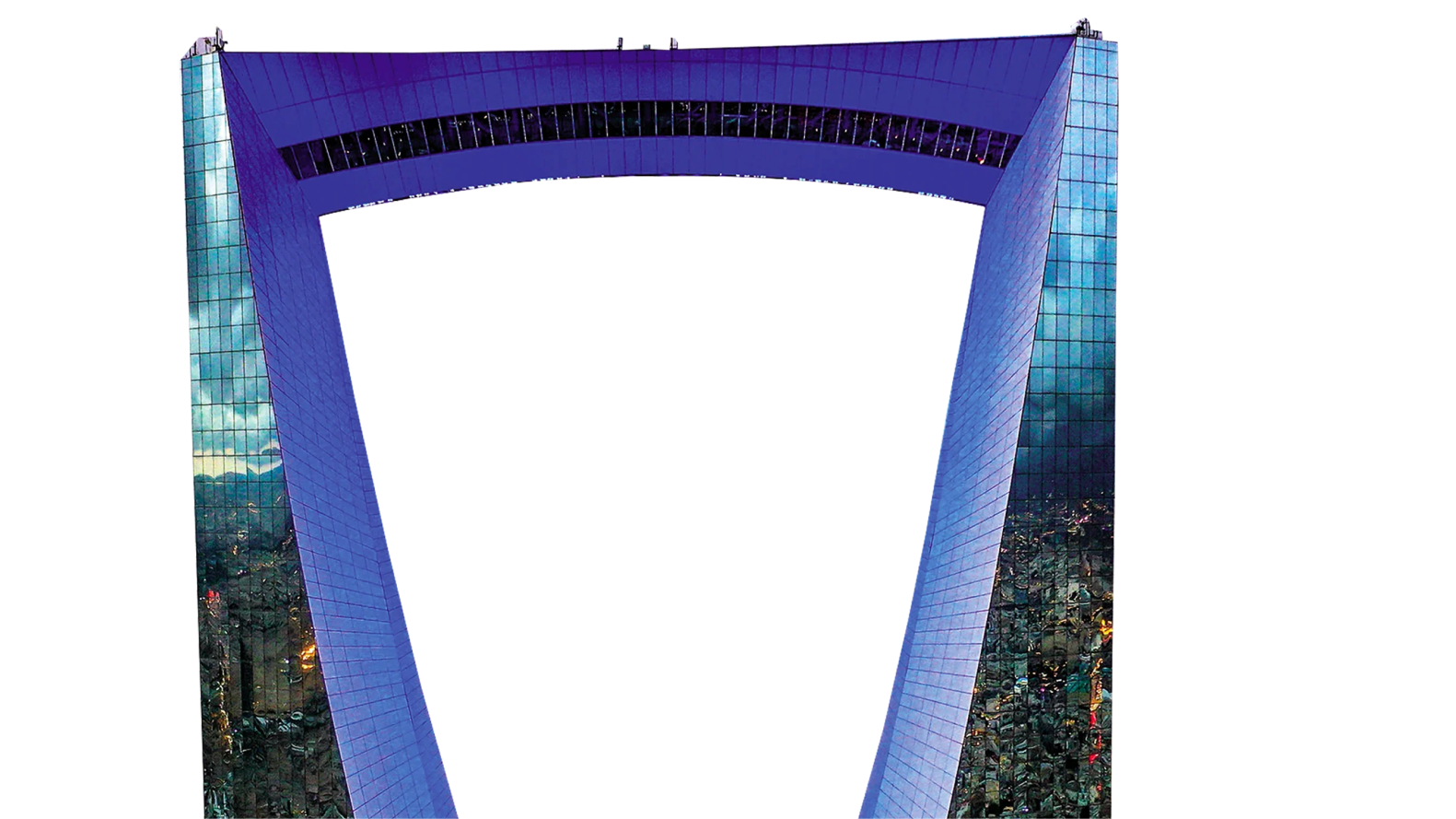

In Saudi Arabia, on our home turf, KHC’s real estate ventures continue to thrive, with landmark projects such as the Kingdom Tower in Riyadh and Jeddah Economic City, home to the highly anticipated Jeddah Tower. Construction has recommenced following a brief hiatus, and, with project completion envisioned by 2028, the 1,000+ metre skyscraper will be the tallest building in the world, not only symbolising KHC’s commitment to innovation and excellence but also standing as a lasting monument to Saudi ingenuity and ambition.

Market segments

More than 40 years of global investment experience