At the moment, there are no entries available for display

(All amounts in Saudi Riyals thousands unless otherwise stated)

1 Corporate Information

Kingdom Holding Company (the “Company” or “KHC”) is a Saudi Joint Stock Company (“JSC”) operating in the Kingdom of Saudi Arabia. The Company was previously formed as a limited liability company and operated under commercial registration number 1010142022 dated 11 Muharram 1417H (corresponding to 28 May 1996). The Ministry of Commerce approved, pursuant to resolution number 128/S dated 18 Jumad Awwal 1428H (corresponding to 4 June 2007), the conversion of the Company into a JSC. The majority shareholder of the Company is His Royal Highness Prince Alwaleed Bin Talal Bin Abdulaziz AlSaud (“Ultimate controlling party”).

The principal activities of the Group are hotel management and operations, commercial services and education and investments.

The shares of the Company commenced trading on the Saudi Stock Exchange on 28 July 2007 after approval by the Capital Market Authority of the Kingdom of Saudi Arabia.

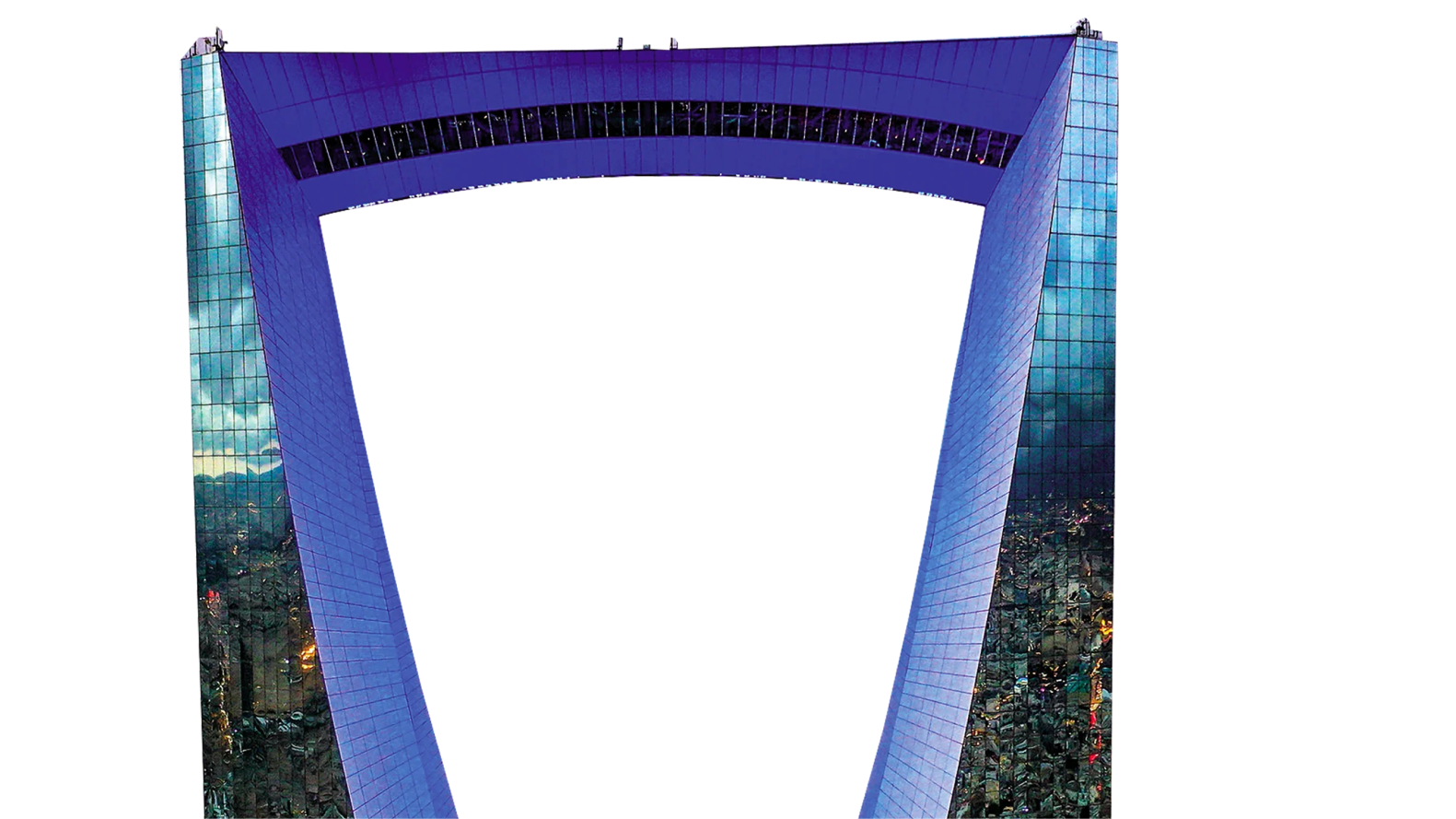

The Company’s head office is located in Riyadh at the following address:

Kingdom Holding Company 66th Floor, Kingdom Centre P.O. Box 1, Riyadh 11321 Kingdom of Saudi Arabia

Climate Change

The Group has reviewed its exposure to climate related and other emerging business risks and has not identified any risks that could materially impact the financial performance or position of the Group as at 31 December 2024.

Liquidity and financial position

As of 31 December 2024, the Group had net current liabilities of Saudi Riyals 2.1 billion (31 December 2023: Saudi Riyals 1.0 billion), primarily due to the maturity of certain current borrowings amounting to Saudi Riyals 3 billion. To manage its liquidity needs, the Group has access to undrawn borrowing facilities of Saudi Riyals 7.9 billion, along with an existing portfolio of liquid, unpledged investments and the option to roll over revolving credit facilities as they mature. Furthermore, management has conducted a cash flow projection analysis for the upcoming twelve months and remains confident that the Group will be able to meet its obligations as they come due.

Accordingly, these consolidated financial statements are prepared on going concern basis.

These consolidated financial statements were authorized for issue by the Company’s Board of Directors on 16 Ramadan 1445H (corresponding to 16 March 2025).

The Company and its subsidiaries (the “Group”) carry out activities through the entities listed below.

1.1 Kingdom 5-KR-11 Limited (KR-11)

KR-11 is a fully owned limited liability company incorporated in the Cayman Islands. The company’s principal activity represents investments in international quoted securities, through its wholly owned subsidiaries.

1.2 Kingdom 5-KR-100 Limited (KR-100)

KR-100 is a fully owned limited liability company incorporated in the Cayman Islands. The company’s principal activity represents ownership and management of mutual funds, through its equity-accounted investees.

1.3 Kingdom 5-KR-132 Limited (KR-132)

KR-132 is a fully owned limited liability company incorporated in the Cayman Islands. The company’s principal activity includes holding investments in the following subsidiaries and equity-accounted investees that own and manage properties and hotels:

| Effective Ownership Percentage |

||

| 2024 |

2023 |

|

| Subsidiaries | ||

| Kingdom Hotel Investments (KHI) – Cayman Islands | 100 | 100 |

| Kingdom 5 KR 35 Group (George V) – France | 100 | 100 |

| Equity-accounted investees (Associates) | ||

| Four Seasons Holding Inc. (FSH Inc.) – Canada | 23.75 | 23.75 |

| Accor S.A. - France (Note 3.2) | 6.8 | 6.3 |

1.4 Kingdom 5-KR-114 Limited (KR-114)

KR-114 is a fully owned limited liability company incorporated in the Cayman Islands. The company holds 58.96% (2023: 58.96%) ownership in Breezeroad Limited, a company which is incorporated in the Cayman Islands which in turn holds a 100% ownership in Savoy Hotels Limited in the United Kingdom.

1.5 Local and regional subsidiaries

The Group also has ownership in the following local and regional subsidiaries and equity-accounted investees:

| Effective Ownership percentage |

Principal activities |

||

| 2024 | 2023 | ||

| Subsidiaries | |||

| Kingdom Real Estate Development Company (KRED) – Saudi Arabia | 100 | 100 | Real estate development and management |

| Kingdom Investment and Development Company (KIDC) – Saudi Arabia | 89.8 | 89.8 | Real estate development and management |

| Kingdom Schools Company Limited (The School) – Saudi Arabia (Note 3.2) | 89.8 | 47 | Education |

| Fashion Village Trading Company Limited (SAKS) – Saudi Arabia | 71.8 | 71.8 | Wholesale and retail merchandiser |

| Real Estate Investment Company (REIC) – Saudi Arabia | 89.8 | 69.4 | Real estate development and management |

| Trade Centre Company Limited (TCCL) – Saudi Arabia | 89.8 | 70.6 | Real estate development and management & hotel management |

| Consulting Clinic SAL (Clinic) – Lebanon | 50.4 | 50.4 | Healthcare |

| Equity-accounted investees (Associates) | |||

| Flynas Company (Flynas) – Saudi Arabia | 37.1 | – | Aviation |

| National Air Services (NAS Holding Company) – Saudi Arabia | 37.1 | 37.1 | Aviation |

| Jeddah Economic Company (JEC) – Saudi Arabia | 35.74 | 33.4 | Real estate development and management |

| Banque Saudi Fransi (BSF) – Saudi Arabia (Note 3.2) | 16.2 | 16.2 | Financial institution |

| East Shura III Company* | 50 | – | |

* Investment of KHC in East Shuraa III is effectively owned through a special purpose vehicle (Sea Front Company Limited) which is 100% owned by KHC.

The principal activities and the various segments of the Group are described in Note 33.

2 Basis of Preparation

2.1 Statement of compliance

These consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”), that are endorsed in the Kingdom of Saudi Arabia and other standards and pronouncements issued by the Saudi Organization for Chartered and Professional Accountants (“SOCPA”).

2.2 Historical cost convention

These consolidated financial statements have been prepared under the historical cost convention, except for the Investments carried at FVOCI and FVTPL, which are measured at fair value.

Further, the employee termination benefits are calculated using the Projected Unit Credit Method (PUCM) and actuarial assumptions.

2.3 New standards and amendments applicable from January 1, 2024

Certain amendments to existing standards became applicable for the current reporting period. The amendments did not have an impact on the consolidated financial statements of the Group and accordingly the Group did not have to change its accounting policies or make any retrospective adjustments.

| Title |

Key requirements |

Effective date |

| Classification of Liabilities as Current or Non-current – Amendments to IAS 1 | The narrow-scope amendments to IAS 1 ‘Presentation of Financial Statements, clarify that liabilities are classified as either current or non-current, depending on the rights that exist at the end of the reporting period. Classification is unaffected by the expectations of the entity or events after the reporting date (e.g., the receipt of a waiver or a breach of covenant). The amendments also clarify what IAS 1 means when it refers to the ‘settlement’ of a liability. | 1 January 2024 |

| Leases on sale and leaseback – Amendment to IFRS 16 | These amendments include requirements for sale and leaseback transactions in IFRS 16 to explain how an entity accounts for a sale and leaseback after the date of the transaction. Sale and leaseback transactions where some or all the lease payments are v-dex or rate are most likely to be impacted. | 1 January 2024 |

| Supplier Finance arrangements – Amendments to IAS 7 and IFRS 7 | These amendments require disclosures to enhance the transparency of supplier finance arrangements and their effects on a company’s liabilities, cash flows and exposure to liquidity risk. The disclosure requirements are the IASB’s response to investors’ concerns that some companies’ supplier finance arrangements are not sufficiently visible, hindering investors’ analysis. | 1 January 2024 |

2.4 Standards, interpretations and amendments issued but not yet effective

Certain new accounting standards and interpretations have been published that are not mandatory for 31 December 2024, reporting periods and have not been early adopted by the Group. The standards, interpretations and amendments issued that are relevant to the Group but are not yet effective are disclosed below:

| Title |

Key requirements |

Effective date |

| Lack of exchangeability – Amendment to IAS 21 | An entity is impacted by the amendments when it has a transaction or an operation in a foreign currency that is not exchangeable into another currency at a measurement date for a specified purpose. A currency is exchangeable when there is an ability to obtain the other currency (with a normal administrative delay), and the transaction would take place through a market or exchange mechanism that creates enforceable rights and obligations. | 1 January 2025 |

| Classification and Measurement of Financial Instruments- Amendment to IFRS 9 and IFRS 7 | These amendments:

|

|

| IFRS 18 – Presentation and Disclosure in Financial Statements | The new standard on presentation and disclosure in financial statements, require more focus on updates to the statement of profit or loss. The key new concepts introduced in IFRS 18 relate to:

|

|

| IFRS 19, ‘Subsidiaries without Public Accountability: Disclosures’ | IFRS 19 specifies the disclosure requirements an entity is permitted to apply instead of the disclosure requirements in other IFRS. A subsidiary may elect to apply this Standard in its financial statements if it does not have public accountability and it has an ultimate or intermediate parent that produces consolidated financial statements available for public use that comply with IFRS. | 1 January 2027 |

The management is in the process of assessing the impact of these standards, amendments or interpretations on future periods and on foreseeable future transactions.

3 Use of Judgements and Estimates

The preparation of consolidated financial statements in conformity with IFRS, that are endorsed in the Kingdom of Saudi Arabia, requires the use of certain critical estimates and judgments that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the reporting date and the reported amounts of revenue and expenses during the reporting period. Estimates and judgments are continually evaluated and are based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. The Group makes estimates and judgments concerning the future.

The resulting accounting estimates will, by definition, seldom equal the related actual results. The estimates and judgements that have a risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next twelve-month period are discussed below:

3.1 Significant estimates

Investment in equity accounted investees – impairment testing

The Group assesses at each reporting date whether there is an indication that an interest in equity-accounted investees may be impaired. If any indication exists, the Group estimates the asset’s recoverable amount. For further details refer Note 4.16 and Note 11.

Goodwill and intangible assets – annual impairment testing

The Group tests whether goodwill and other intangible assets with indefinite useful life have suffered any impairment on an annual basis. For the 2024 and 2023 reporting periods, the recoverable amount of the cash-generating units (CGUs) was determined based on fair value less costs of disposal which require the use of assumptions. For further details refer Note 14.

Estimation of fair value - Investment in a social media services company and certain Oil and Gas Companies’ securities

The Group has exercised judgement in estimating the fair value of an investment in a social media services company and certain Oil and Gas Companies’ securities as at 31 December 2024 as part of the level 3 measurements of such financial instruments. For further details refer to Note 10.1 and 10.2.

3.2 Significant judgements

Kingdom School Company Limited

The Group is the largest shareholder in KS while the remaining shares are held by twelve investors. The CEO of the Group is also the CEO of the KS. As a result of shareholder’s agreement, the Group is exposed to, or has rights to, variable returns from its involvement with the company and has the ability to affect those returns through its power to direct the activities of the company. The Group has therefore determined that it has control over KS, even though it only holds 47% of the voting rights.

Further, the Group has advanced funds to various minority shareholders of KS for the purpose of acquiring their respective shareholdings in the company. Upon completion of these transactions, the Group’s effective ownership in KS will increase to 89.8%. While the legal formalities for these transactions are still pending, the Group has recognized its ownership at 89.8%, reflecting the substance of the arrangements, with the formalities expected to be finalized in the near future.

Also see Note 22 increase in effective stake in NCI.

Accor S.A France

The Group has a Board seat and other committee representations and actively participates in the policy making process of the company and it is the second largest strategic investor in the company. The CEO of the hospitality arm of the Group is the representative Board member and actively participates in the decision-making process through his presence on the Board and through significant interaction with key management of Accor Hotels. The Group has therefore determined that it has significant influence over this entity. During the year, the company’s shareholders approved a share buyback. As a result of this transaction, the group shareholding increased slightly from 6.3% to 6.8%.

Banque Saudi Fransi (BSF) – Saudi Arabia

The Group is the largest shareholder of the bank and has a Board seat and other committee representations and participates in the policy making process of the bank. The CEO of the Group is also the Vice Chairman of the Board of Directors of the bank. The Group has therefore determined that it has significant influence over the bank, even though it only holds 16.2% of the voting rights.

4 Material Accounting Policies

The material accounting policies applied by the Group in the preparation of these consolidated financial statements are set out below. These policies have been consistently applied to all years presented, unless otherwise stated.

4.1 Foreign currency translation

(a) Functional and presentation currency

Items included in the financial statements of each of the Group’s entities are measured using the currency of the primary economic environment in which the entity operates (the ‘functional currency’). These consolidated financial statements are presented in Saudi Riyals which is the Company’s functional and Group’s presentation currency.

(b) Transactions and balances

Foreign currency transactions are translated into the functional currency using the exchange rates at the dates of the transactions. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation of monetary assets and liabilities denominated in foreign currencies at year end exchange rates are generally recognized in the consolidated statement of income.

Foreign exchange gains and losses that relate to borrowings are presented in the consolidated statement of income, within finance costs. All other foreign exchange gains and losses are presented in the consolidated statement of income on a net basis within other gains/(losses).

Non-monetary items that are measured at fair value in a foreign currency are translated using the exchange rates at the date when the fair value was determined. Translation differences on assets and liabilities carried at fair value are reported as part of the fair value gain or loss. For example, translation differences on non-monetary assets and liabilities such as equities held at FVTPL are recognized in the consolidated statement of income as part of the fair value gain or loss and translation differences on non-monetary assets such as equities classified as at FVOCI are recognized in consolidated statement of comprehensive income.

(c) Group companies

The results and financial position of foreign operations (none of which has the currency of a hyperinflationary economy) that have a functional currency different from the presentation currency are translated into the presentation currency as follows:

- assets and liabilities for each statement of financial position presented are translated at the closing rate at the date of that statement of financial position;

- income and expenses for each statement of income and statement of comprehensive income are translated at average exchange rates (unless this is not a reasonable approximation of the cumulative effect of the rates prevailing on the transaction dates, in which case income and expenses are translated at the dates of the transactions); and

- all resulting exchange differences are recognized in the consolidated statement of comprehensive income.

On consolidation, exchange differences arising from the translation of any net investment in foreign entities, and of borrowings are recognized in consolidated statement of comprehensive income. When a foreign operation is sold or any borrowings forming part of the net investment are repaid, the associated exchange differences are reclassified to the consolidated statement of income, as part of the gain or loss on sale.

Goodwill and fair value adjustments arising on the acquisition of a foreign operation are treated as assets and liabilities of the foreign operation and translated at the closing rate.

4.2 Principles of consolidation and equity accounting

i. Subsidiaries

Subsidiaries are all entities (including structured entities) over which the Group has control. The Group controls an entity when the Group is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power to direct the activities of the entity. Subsidiaries are fully consolidated from the date on which control is transferred to the Group. They are deconsolidated from the date that control ceases.

The acquisition method of accounting is used to account for business combinations by the Group (See Note 4.3).

Intercompany transactions, balances and unrealized gains on transactions between Group companies are eliminated. Unrealized losses are also eliminated unless the transaction provides evidence of an impairment of the transferred asset. Accounting policies of subsidiaries have been changed where necessary to ensure consistency with the policies adopted by the Group.

Non-controlling interests (‘NCI’) in the results and equity of subsidiaries are shown separately in the consolidated statement of income, consolidated statement of comprehensive income, consolidated statement of changes in equity and consolidated statement of financial position, respectively.

ii. Associates

Associates are all entities over which the Group has significant influence but not control or joint control. Investments in associates are accounted for using the equity method of accounting (see (iii) below), after initially being recognized at cost.

iii. Equity method

Under the equity method of accounting, the investments are initially recognized at cost and adjusted thereafter to recognize the Group’s share of the post-acquisition profits or losses of the investee in the consolidated statement of income, and the Group’s share of movements in other comprehensive income of the investee in consolidated statement of comprehensive income. Dividends received or receivable from associates are recognized as a reduction in the carrying amount of the investment.

When the Group’s share of losses in an equity-accounted investment equals or exceeds its interest in the entity, including any other unsecured long-term receivables, the Group does not recognize further losses, unless it has incurred obligations or made payments on behalf of the other entity.

Unrealized gains on transactions between the Group and its associates are eliminated to the extent of the Group’s interest in these entities. Unrealized losses are also eliminated unless the transaction provides evidence of an impairment of the asset transferred. Accounting policies of equity accounted investees have been changed where necessary to ensure consistency with the policies adopted by the Group.

The carrying amount of equity-accounted investments is tested for impairment in accordance with the policy described in Note 4.18.

4.3 Business combinations

The acquisition method of accounting is used to account for all business combinations, regardless of whether equity instruments or other assets are acquired. The consideration transferred for the acquisition of a subsidiary comprises the:

- fair values of the assets transferred;

- liabilities incurred to the former owners of the acquired business;

- equity interests issued by the Group;

- fair value of any asset or liability resulting from a contingent consideration arrangement; and

- fair value of any pre-existing equity interest in the subsidiary.

Identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination are, with limited exceptions, measured initially at their fair values at the acquisition date.

The Group recognizes any non-controlling interest in the acquired entity on an acquisition-by-acquisition basis either at fair value or at the non-controlling interest’s proportionate share of the acquired entity’s net identifiable assets.

Acquisition-related costs are expensed as incurred.

The excess of the

- consideration transferred,

- amount of any non-controlling interest in the acquired entity, and

- acquisition-date fair value of any previous equity interest in the acquired entity

over the fair value of the net identifiable assets acquired is recorded as goodwill. If those amounts are less than the fair value of the net identifiable assets of the business acquired, the difference is recognized directly in the consolidated statement of income as a bargain purchase.

If the business combination is achieved in stages, the acquisition date carrying value of the acquirer’s previously held equity interest in the acquiree is re-measured to fair value at the acquisition date. Any gains or losses arising from such re-measurement are recognized in the consolidated statement of income.

4.4 Financial instruments

(i) Financial assets

Classification

The Group classifies its financial assets in the following measurement categories:

- those to be measured subsequently at fair value (either through other comprehensive income (OCI) or through profit or loss), and

- those to be measured at amortized cost.

Classification of debt financial assets (long-term receivable) depends on the Group’s business model for managing its financial assets and the contractual terms of the cash flows.

The group holds the debt financial assets with the objective of collecting the contractual cash flows and therefore measures them subsequently at amortised cost using the effective interest method.

Interest income from these financial assets is included in finance income using the effective interest rate method. Any gain or loss arising on derecognition is recognised directly in profit or loss and presented in other gains/ (losses) together with foreign exchange gains and losses. Impairment losses are presented as separate line item in the statement of profit or loss.

For assets measured at fair value, gains and losses are either recorded in the consolidated statement of income or OCI. For investments in equity instruments that are not held for trading, this will depend on whether the Group has made an irrevocable election at the time of initial recognition to account for the equity investment at FVOCI.

Recognition and de-recognition

Regular way purchases and sales of financial assets are recognized on trade-date, the date on which the Group commits to purchase or sell the asset. Financial assets are de-recognized when the rights to receive cash flows from the financial assets have expired or have been transferred and the Group has transferred substantially all the risks and rewards of ownership.

Measurement

At initial recognition, the Group measures a financial asset at its fair value plus, in the case of a financial assets not at FVTPL, transaction costs that are directly attributable to the acquisition of the financial asset. Transaction costs of financial assets carried at FVTPL are expensed in the consolidated statement of income.

The Group subsequently measures all equity investments at fair value. Where the Group’s management has elected to present fair value gains and losses on equity investments in OCI, there is no subsequent reclassification of fair value gains and losses to the consolidated statement of income following the de-recognition of the investment. Dividends from such investments continue to be recognized in the consolidated statement of income when the Group’s right to receive dividends is established.

Changes in the fair value of financial assets at FVTPL are recognized as revenues in the consolidated statement of income as applicable. Impairment losses (and reversal of impairment losses) on equity investments measured at FVOCI are not reported separately from other changes in fair value.

Impairment

The Group assesses on a forward-looking basis the Expected Credit Losses (“ECL”) associated with its financial assets carried at amortized cost. ECL reflects an unbiased and probability-weighted amount which is determined by evaluating a range of possible outcomes, the time value of money and reasonable and supportable information about past events, current conditions and forecasts of future economic conditions. The financial assets of the Group subject to ECL are cash and cash equivalents, trade receivables, long-term receivable and due from related parties. Also refer Note 31. For long-term receivable, the Group applies a three-stage model for impairment, based on changes in credit quality since initial recognition. A financial instrument that is not credit-impaired on initial recognition is classified in Stage 1. Financial assets in Stage 1 have their ECL measured at an amount equal to the portion of lifetime ECL that results from default events possible within the next 12 months or until contractual maturity, if shorter (“12 Months ECL”). If the Group identifies a significant increase in credit risk (“SICR”) since initial recognition, the asset is transferred to Stage 2 and its ECL is measured based on ECL on a lifetime basis, that is, up until contractual maturity but considering expected prepayments, if any (“Lifetime ECL”). If the Group determines that a financial asset is credit-impaired, the asset is transferred to Stage 3 and its ECL is measured as a Lifetime ECL.

De-recognition

A financial asset or a part of a financial asset is de-recognized when:

- The rights to receive cash flows from the asset have expired, or

- The Group has transferred its rights to receive cash flows from the asset or has assumed an obligation to pay the received cash flows in full without material delay to a third party under a ‘pass-through’ arrangement; and either:

- The Group has transferred substantially all the risks and rewards of the asset, or

- The Group has neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control of the asset.

(ii) Financial liabilities

Financial liabilities are recognized at the time when the Group becomes a party to the contractual provisions of the instrument. Financial liabilities are recognized initially at fair value less any directly attributable transaction cost. Subsequent to initial recognition, these are measured at amortized cost using the effective interest rate method.

A financial liability is de-recognized when the obligation under the liability is discharged or cancelled or expired. Where an existing financial liability is replaced by another from the same lender on substantially different terms, or the terms of an existing liability are substantially modified, such an exchange or modification is treated as a de-recognition of the original liability and the recognition of a new liability, and the difference in respective carrying amounts is recognized in the consolidated statement of income. The Group’s financial liabilities include borrowings, dividends payable, trade payables, accrued expenses and other current liabilities and due to related parties.

Offsetting financial assets and liabilities

Financial assets and liabilities are offset, and the net amount reported in the consolidated statement of financial position where the Group currently has a legally enforceable right to offset the recognized amounts, and there is an intention to settle on a net basis or realize the asset and settle the liability simultaneously.

4.5 Cash and cash equivalents

Cash and cash equivalents include cash on hand, bank balances and short-term deposits with original maturities of three months or less, which are subject to an insignificant risk of changes in value less restricted cash. Restricted balances are excluded from cash and cash equivalents for the purposes of the consolidated statement of cash flows.

4.6 Trade receivables

Trade receivables are amounts due from customers for goods sold or services performed in the ordinary course of business. They are generally due for settlement within 30 days and therefore are all classified as current. Trade receivables are recognized initially at the amount of consideration that is unconditional unless they contain significant financing components, when they are recognized at fair value. The Group holds the trade receivables with the objective to collect the contractual cash flows and therefore measures them subsequently at amortized cost using the effective interest rate method.

4.7 Investment properties

Investment properties comprise property held for capital appreciation, long-term rental yields or both, and are carried at cost less accumulated depreciation and accumulated impairment losses, if any. Investment properties also include property that is being constructed or developed for future use as investment properties. In addition, land, if any held for undetermined use is classified as investment properties and is not depreciated. When the development of investment properties commences, it is classified as “Assets under construction” until development is complete, at which time it is transferred to the respective category and depreciated using straight-line method at rates calculated to reduce the cost of assets to their estimated residual value over their expected useful lives of 4 to 99 years.

Maintenance and normal repairs which do not materially extend the estimated useful life of an asset are charged to the consolidated statement of income as and when incurred.

Gains and losses on disposals are determined by comparing proceeds with the carrying amount. These are recognized and presented separately within other losses - net in the consolidated statement of income.

4.8 Property and equipment

Initial recognition

Property and equipment are recognized as an asset when, and only when, it is probable that future economic benefits will flow to the Group, and the cost of the asset can be measured reliably. Property and equipment are recognized and measured initially at cost. Cost includes the fair value of the consideration given to acquire the asset and any directly attributable cost.

When parts of property and equipment are significant in cost in comparison to the total cost of the item and such parts have a useful life different than other parts, the Group recognizes such parts as individual assets and depreciates them accordingly.

Subsequent measurement

The Group adopted the cost model to measure the entire class of property and equipment. After recognition as an asset, an item of property equipment is carried at its cost less any accumulated depreciation and any accumulated impairment losses.

Subsequent expenditure

Subsequent costs are included in the asset’s carrying amount or recognized as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Group and the cost of the item can be measured reliably.

Depreciation

Useful lives are determined by management based on the expected usage of the asset, expected physical wear and tear, technical and commercial obsolescence, legal and similar limits on the use of the assets and other similar factors. Depreciation is calculated on a straight-line basis over the below useful lives and is recognized in the consolidated statement of income:

| Description |

Number of years |

| Buildings (hotels) | 20 to 99 years or the lease term |

| Equipment | 5 to 13 |

| Furniture and fixtures | 4 to 20 |

| Others | 4 to 14 |

Land and assets under construction that are not ready for intended use are not depreciated.

De-recognition

Property and equipment are de-recognized when they have been disposed or no future economic benefits are expected to arise from their use or disposal. Gains or losses arising from de-recognition of an item of property and equipment is included in the consolidated statement of income at the time the item is de-recognized.

4.9 Intangible assets

Intangible assets acquired separately are measured at cost upon initial recognition. Following initial recognition, intangible assets are carried at cost less accumulated amortization and accumulated impairment losses, if any.

The useful lives of intangible assets are assessed to be either finite or indefinite. Intangible assets with finite lives are amortized over the useful economic life and assessed for impairment whenever there is an indication that the intangible asset may be impaired. The amortization period and the amortization method for an intangible asset with a finite useful life are reviewed at least at each financial year-end. Changes in the expected useful life or the expected pattern of consumption of future economic benefits embodied in the asset, are accounted for by changing the amortization period or method, as appropriate, and are treated as changes in accounting estimates. The amortization expense on intangible assets with finite lives is recognized in the consolidated statement of income in the expense category consistent with the function of the intangible asset.

Goodwill is measured as described in Note 4.3. Goodwill and brands identified on acquisitions of subsidiaries are included in intangible assets. Goodwill and brands are not amortized but are tested for impairment annually, or more frequently if events or changes in circumstances indicate that these might be impaired, and are carried at cost less accumulated impairment losses, if any. Gains and losses on the disposal of an entity include the carrying amount of goodwill or brands relating to the entity sold.

Goodwill is allocated to cash-generating units for the purpose of impairment testing. The allocation is made to those cash-generating units or groups of cash-generating units that are expected to benefit from the business combination in which the goodwill arose. The units or groups of units are identified at the lowest level at which goodwill is monitored for internal management purposes, being the operating segments.

4.10 Borrowings

Borrowings are recognized initially at fair value, net of transaction costs incurred. Borrowings are subsequently measured at amortized cost. Any difference between the proceeds (net of transaction costs) and the redemption value is recognized in the consolidated statement of income over the period of the borrowings using the effective interest rate method. Borrowing costs are recognized within finance charges in the period in which they are incurred.

Borrowings are classified as current liabilities unless the Group has an unconditional right to defer settlement of the liability for at least 12 months after the reporting period.

General and specific finance costs that are directly attributable to the acquisition, construction or production of a qualifying asset are capitalized during the period of time that is required to complete and prepare the asset for its intended use or sale. Qualifying assets are assets that necessarily take a substantial period of time to get ready for their intended use or sale. There were no borrowings costs that required capitalization during 2023.

Borrowings are derecognized from the consolidated statement of financial position when the obligation specified in the contract is discharged, cancelled or expired. The difference between the carrying amount of a financial liability that has been extinguished or transferred to another party and the consideration paid, including any non-cash assets transferred or liabilities assumed, is recognized in consolidated statement of income as other income or finance costs.

4.11 Trade and other payables

These amounts represent liabilities for goods and services, provided to the Group prior to the end of financial year, which are unpaid. The amounts are unsecured and are presented as current liabilities unless payment is not due within 12 months after the reporting period. They are recognized initially at their fair value and subsequently measured at amortized cost using the effective interest rate method.

4.12 Zakat and income tax

The Group is subject to zakat and income tax in accordance with the regulations of the Zakat, Tax and Customs Authority (“ZATCA”). Zakat, for the Group and its subsidiaries subject to zakat, is calculated based on higher of approximate zakat base and adjusted profit and charged to the consolidated statement of income. Additional amounts, if any, are accounted for when determined to be required for payment.

Foreign subsidiaries and foreign branches are subject to income taxes in their respective countries of domicile, such income taxes are charged to the consolidated statement of income.

Income tax based on the applicable income tax rate is adjusted by changes in deferred tax assets and liabilities attributable to temporary differences and to unused tax losses. Deferred income tax is provided in full, using the liability method, on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the consolidated financial statements. Deferred income tax is not accounted for if it arises from initial recognition of an asset or liability in a transaction other than a business combination that at the time of the transaction affects neither accounting nor taxable profit nor loss. Deferred income tax is determined using tax rates (and laws) that have been enacted or substantially enacted by the end of the reporting period and are expected to apply when the related deferred income tax asset is realized or the deferred income tax liability is settled.

Deferred tax assets are recognized only if it is probable that future taxable amounts will be available to utilize those temporary differences and losses.

Deferred tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets and liabilities and when the deferred tax balances relate to the same taxation authority. Current tax assets and tax liabilities are offset where the Group has a legally enforceable right to offset and intends either to settle on a net basis, or to realize the asset and settle the liability simultaneously.

Withholding tax

The Company and its Saudi Arabian subsidiaries also withhold taxes on certain transactions with non-resident parties in the Kingdom of Saudi Arabia as required under Saudi Arabian Tax Law.

4.13 Dividends

Dividend payable is recognized for the amount of any dividend declared being appropriately authorized and no longer at the discretion of the Group, on or before the end of the reporting period but not distributed at the end of the reporting period. As per the corporate laws in the Kingdom of Saudi Arabia, a distribution is authorized when it is approved by the shareholders. A corresponding amount is recognized directly in equity.

4.14 Employee benefits and post-employment benefits

Short-term employee benefits

Short-term employee benefits are expensed as the related service is provided. A liability is recognized for the amount expected to be paid if the Group has a present legal or constructive obligation to pay this amount as a result of past service provided by the employee and the obligation can be estimated reliably.

Post-employment obligation

The Group operates a post-employment benefit scheme plans driven by the local laws of the countries in which the Group entities operate.

The post-employment benefits plans are not funded. Valuations of the obligations under those plans are carried out using actuarial techniques on the projected unit credit method. The costs relating to such plans primarily consist of the present value of the benefits attributed on an equal basis to each year of service and the interest on this obligation in respect of employee service in previous years.

Current and past service costs related to post-employment benefits are recognized immediately in the consolidated statement of income while unwinding of the liability at discount rates used are recorded as financial cost.

Re-measurement gains and losses arising from experience adjustments and changes in actuarial assumptions are recognized directly in other comprehensive income and transferred to other reserves in the consolidated statement of changes in equity in the period in which they occur.

Changes in the present value of the defined benefit obligations resulting from plan amendments or curtailments are recognized immediately in the consolidated statement of income as past service costs. End of service payments are based on employees’ final salaries and allowances and their cumulative years of service, as stated in the laws of the respective countries in which the Group operates.

4.15 Share capital

Ordinary shares are classified as equity.

4.16 Impairment of non-financial assets

The Group assesses at each reporting date whether there is an indication that a non-financial asset may be impaired. If any indication exists, or when annual impairment testing for an asset is required, the Group estimates the asset’s recoverable amount. An asset’s recoverable amount is the higher of an asset’s or cash-generating unit’s fair value less costs of disposal and its value-in-use and is determined for an individual asset, unless the asset does not generate cash inflows that are largely independent of those from other assets or groups of assets. Where the carrying amount of an asset or CGU exceeds its recoverable amount, the asset is considered impaired and is written down to its recoverable amount. In assessing value-in-use, the estimated future cash flows are discounted to their present value using a Discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. In determining fair value less costs of disposal, an appropriate valuation model is used.

Impairment losses are recognized in consolidated statement of income in expense categories consistent with the function of the impaired asset.

For assets excluding goodwill, an assessment is made at each reporting date as to whether there is any indication that previously recognized impairment losses may no longer exist or may have decreased. If such indication exists, the Group estimates the asset’s or cash-generating unit’s recoverable amount.

A previously recognized impairment loss is reversed only if there has been a change in the assumptions used to determine the asset’s recoverable amount since the last impairment loss was recognized. The reversal is limited so that the carrying amount of the asset does not exceed its recoverable amount, nor exceed the carrying amount that would have been determined, net of depreciation, had no impairment loss been recognized for the asset in prior years. Such reversal is recognized in the consolidated statement of income.

4.17 Provisions

Provisions are recognized when the Group has a present obligation (legal or constructive) as a result of a past event, it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and a reliable estimate can be made of the amount of the obligation. Provisions are not recognized for future operating losses.

Where there are a number of similar obligations, the likelihood that an outflow will be required in settlement is determined by considering the class of obligations as a whole. A provision is recognized even if the likelihood of an outflow with respect to any one item included in the same class of obligations may be small.

Provisions are measured at the present value of management’s best estimate of the expenditure required to settle the obligation at the end of the reporting period. The discount rate used to determine the present value is a pre-zakat and income tax rate that reflects current market assessments of the time value of money and the risks specific to liability. The increase in the provision due to the passage of time is recognized as interest expense. The expense relating to a provision is presented in the consolidated statement of income.

4.18 Revenue recognition

- Revenue from hotel operations

- Rental income

- Educational services

- Retail

- Investment measured at FVTPL

Revenue is primarily derived from hotel operations, including the rental of rooms, food and beverage sales and other services from owned hotels. Revenue is recognized when rooms are occupied, food and beverages are sold and services are performed.

Revenue is recognized net of returns, rebates, municipality fees and discounts. Service charges collected from the customers are recorded as revenue, as the Group is the principal / primary obligor and is required to provide the service to the customer in return for the receipt of the service charge.

A receivable is recognized when the goods are delivered, as this is the point in time that the consideration is unconditional because only the passage of time is required before the payment is due. Usually there are no rights to return attached, therefore no refund liabilities are required to be recognized.

The Group owns offices, mall spaces, temporary spaces etc. The revenue is recognized on a straight-line basis over the term of the lease taking into consideration any incentives given, the rent received in advance, if any is recognized as a liability. The rental contracts are relatively simple and are fixed price contracts where the customer pays the fixed amount based on a payment schedule. If the services rendered by the Group exceed the payment, an asset is recognized. If the payments exceed the services rendered, a liability is recognized.

Revenue is recognized when the educational services are performed. Revenue is shown net of discounts and scholarships. The Group recognizes revenue when the amount of revenue can be reliably measured, it is probable that future economic benefits will flow to the Group and when specific criteria have been met.

Revenue is recognized when goods are sold and invoices are issued to customers. Revenue is recorded net of discounts.

The fair value gains or losses on investments measured at FVTPL are recognized as operational revenues as the Group invests in those equity investments as its operating activity in its normal course of business.

Financing component

The Group does not expect to have any contracts where the period between the transfer of the promised goods or services to the customer and payment by the customer exceeds one year. As a consequence, the Group does not adjust any of the transaction prices for the time value of money.

4.19 Earnings per share

Basic earnings per share

Basic earnings per share is calculated by dividing:

- the profit attributable to owners of the Group, excluding any costs of servicing equity other than ordinary shares

- by the weighted average number of ordinary shares outstanding during the financial year, adjusted for bonus elements, if any, in ordinary shares issued during the year and excluding treasury shares.

The Group does not have any share options, uncalled or partially paid shares, deferred or convertibles notes and therefore there is no difference between basic and diluted earnings per share.

4.20 Segment reporting

An operating segment is a component of the Group that engages in business activities from which it may earn revenues and incur expenses, including revenues and expenses that relate to transactions with any of the Group’s other components. Operating segments are reported in a manner consistent with the internal reporting provided to the Chief Operating Decision Maker (“CODM”). Board of Directors (BOD) is identified as CODM of the Group.

Reportable segments are disclosed separately at least where, total revenue is more than 10% of the total revenue of the Group, or absolute amount of profit or loss is more than 10% of combined reported profit of all segments (excluding loss making segments) and combined reported loss of all segments (excluding profit making segments), or total assets are more than 10% of total assets of the Group.

4.21 Derivative financial instruments

The Group utilizes derivative financial instruments to manage certain market risk exposures. The Group does not use derivative financial instruments for speculative purposes; however, it may choose not to designate certain derivatives as hedges for accounting purposes. The use of derivative instruments is subject to limits and the positions are regularly monitored and reported to senior management.

Written options

The Group uses ‘European Style’ written options contracts to manage its exposure to fair value movements on its certain investments at fair value. These contracts permit net settlement in cash or other financial assets equivalent to the change in the contract’s fair value and hence these contracts are accounted for as a derivative financial instrument in the period between trade and settlement date. On initial recognition, the net fair value of these contract itself is recognized as a derivative financial liability at the trade date. The Group receives an option premium as consideration for entering written options contracts on the trade date from the counter party (i.e., seller of the written options contract). Any subsequent changes at each reporting date in the fair value of these written options are recognised immediately in consolidated statement of income and are included in other gains / (losses).

Interest Rate Swaps

The Group uses interest rate swap contracts to manage its exposure to interest rate movements on its long-term borrowings. Other financial liabilities (excluding long term-borrowings) are primarily non-interest bearing.

4.22 Dividend Income

Dividends are received from financial assets measured at fair value through other comprehensive income (FVOCI). Dividends are recognised as dividend income in consolidated statement of income when the right to receive payment is established.

5 Cash and Cash Equivalents

| 2024 |

2023 |

|

| Cash and cash equivalents (Note 5.1) | 1,689,658 | 1,923,789 |

| Less: Restricted cash (Note 5.2) | (193,755) | (298,602) |

| Cash and cash equivalents in the consolidated statement of cash flows | 1,495,903 | 1,625,187 |

5.1 Cash and cash equivalents include deposit with a related party (associate) amounting to Saudi Riyals 26.2 million (2023: Saudi Riyals 134.2 million).

5.2 Restricted cash and bank balance are related to the restrictions placed by the banks for the utilization of certain funds.

6 Investments at FVTPL

The Group classifies those equity investments at FVTPL for which it has not elected to recognize fair value gains and losses through other comprehensive income at initial recognition. As at 31 December 2024, FVTPL investments consist of unquoted securities.

The movement in FVTPL investments is set out below:

| 2024 |

2023 |

|

| FVTPL | ||

| 1 January | 232,576 | 105,256 |

| Addition | 10,845 | – |

| Changes in fair value | – | 127,320 |

| 31 December | 243,421 | 232,576 |

7 Trade and Other Receivables

| 2024 |

2023 |

|

| Trade receivables (current) | 575,877 | 751,804 |

| Less: provision for impairment of trade receivable | (323,492) | (322,318) |

| 252,385 | 429,486 | |

| Long-term receivables (non-current) (Note 12) | – | 1,250,399 |

| Total receivables | 252,385 | 1,679,885 |

Following is the breakdown of net receivables:

| 2024 |

2023 |

|

| Receivables from real estate (non-current) | – | 1,250,399 |

| Receivables from guests | 46,343 | 52,367 |

| Receivables from tenants | 103,026 | 100,645 |

| Receivables from medical operations | 5,701 | 5,701 |

| Receivable related to sale of FVOCI securities | – | 254,739 |

| Receivable from others | 97,315 | 16,034 |

| Trade receivables (current) | 252,385 | 429,486 |

During the year ended 31 December 2024, the receivable related to the sale of Oil and Gas companies, Telefonica securities amounting to Saudi Riyals 255 million, and a long-term receivable of Saudi Riyals 1.3 billion due from a third party was fully settled in cash.

Due to the short-term nature of the trade receivables and determination of the carrying value of the long-term receivable at fair market rate of discount, their carrying amount is not significantly different from their fair value. Also see Note 31.

Trade receivables are expected, on the basis of experience, to be fully recoverable. Generally, it is not the practice of the Group to obtain collateral over trade receivables. Thus, trade receivable balances are unsecured.

The following table shows movement in provision for impairment of trade receivable:

| 2024 |

2023 |

|

| Balance at the beginning of the year | 322,318 | 327,471 |

| Provision/(Reversal) during the year | 1,174 | (5,153) |

| Balance at end of the year | 323,492 | 322,318 |

Information about the impairment of trade and other receivables and their credit quality, and the Company’s exposure to credit risk, currency risk and interest rate risk can be found in Note 31.

8 Prepayments and Other Current Assets

| 2024 |

2023 |

|

| Prepaid expenses and other current assets | 141,262 | 123,569 |

| Inventories | 31,503 | 31,810 |

| Advances to suppliers | 153,874 | 69,124 |

| Value added tax claims receivable | 2,470 | 5,723 |

| 329,109 | 230,226 |

9 Related Party Transactions and Balances

Related parties comprise the shareholders, directors, associate companies and key management personnel and business over which they exercise control or significant influence. Related parties also include entities in which certain directors or senior management have an interest.

The transactions with related parties represent rental services, maintenance and other general services rendered to or purchased from related parties of the Group including positions in certain listed entities. Balances due to and due from related parties are outstanding balances in lieu of such transactions. Related party balances, other than those disclosed elsewhere in these consolidated financial statements, as at 31 December are as follows:

| Name |

Relationship |

2024 |

2023 |

| Due from related parties: | |||

| Azizia Commercial Investment Company (Note 9.1) | Entity under common control | 114,207 | 114,207 |

| Others | Associate | 686 | 9,651 |

| Total | 114,893 | 123,858 | |

| Due to related parties: | |||

| Kingdom Oasis – Current (Note 9.4) | Entity under common control | – | 100,000 |

| Others – Current | Associates | 240 | 1,115 |

| Qatar Investment Authority – Katara | |||

| Hospitality (Note 9.2) – Non-Current | Non-controlling interest | 510,799 | 440,793 |

| Total | 511,039 | 541,908 |

See Note 5 and Note 16 for cash and borrowings balances held with a related party that is an equity-accounted investee (Banque Saudi Fransi). There are no other significant related party transactions that warrant separate disclosure in these consolidated financial statements.

| 2024 | 2023 | |

| Short and long-term benefits | 36,412 | 23,818 |

| Others | 7,290 | 15,370 |

| 43,702 | 39,188 |

10 Investments at FVOCI

Financial assets at fair value through other comprehensive income comprise equity securities which are not held for trading, and for which the Group has made an irrevocable election at initial recognition to recognize changes in fair value through other comprehensive income rather than the consolidated statement of income as these are strategic investments and the Group considered such election to be more relevant. FVOCI investments consist of international, local and regional quoted securities.

(a) FVOCI investments consists of the following:

| 2024 |

2023 |

|

| International | 20,666,125 | 18,145,850 |

| Local and regional | 1,224,119 | 1,356,717 |

(b) The movement in FVOCI is set out below:

| 2024 |

2023 |

|

| Cost: | ||

| 1 January - Note 10.2 | 26,260,691 | 33,798,908 |

| Additions - Note 9.3 & Note 10.3 | 3,053,375 | 3,173,907 |

| Disposals during the year - Note 10.1 | (4,835,781) | (10,712,124) |

| 31 December | 24,478,285 | 26,260,691 |

| Fair value reserve for investments at FVOCI: | ||

| 1 January | (6,758,124) | (14,712,982) |

| Unrealized gain during the year | 4,219,953 | 8,983,839 |

| Unrealized loss during the year | (996,753) | (4,964,663) |

| Realized loss transferred to retained earnings upon disposal | 1,162,431 | 3,935,682 |

| 31 December | (2,372,493) | (6,758,124) |

| Net carrying amount | 22,105,792 | 19,502,567 |

The investments at FVOCI are denominated in the following currencies:

| 2024 |

2023 |

|

| US Dollar | 16,659,910 | 11,541,747 |

| Euro | 3,998,770 | 6,538,901 |

| Russian Rubles (‘RR’) | 313,000 | 97,452 |

| Saudi Riyals | 1,134,112 | 1,324,467 |

| 22,105,792 | 19,502,567 |

10.1 Investments in Oil and Gas Companies’ securities

The Group maintains investments in certain Oil and Gas Companies’ securities that were dual-listed on both the London Stock Exchange (LSE) and Moscow Stock Exchange (MSE). The ongoing conflict between Russia and Ukraine led to the suspension of trading on the LSE in the first half of 2022, preventing the Group from trading its shares on the MSE from that point onward.

In the latter half of 2023, the Group successfully liquidated a portion of these securities, generating sales proceeds of Saudi Riyals 1.0 billion and recognized a realized loss of Saudi Riyals 0.27 billion for the year ended 31 December 2023. The remaining securities primarily represent purchase transactions executed by the Group after 1 March 2022. Challenges in disposing of these remaining securities have arisen due to increased regulatory and administrative barriers enacted by the Russian government.

To assess the fair value of the remaining Oil and Gas Companies’ securities, management used the trading price prevalent on MSE as at 31 December 2024, amounting to Saudi Riyals 980 million (2023: Saudi Riyals 1,190 million). This amount was then reduced by 70% (2023: 92%) to account for the regulatory/administrative constraints. The decrease in the discount factor from 92% to 70% reflects an expected improvement in regulatory flexibility concerning the trading and transfer of such securities. A 5% change in this percentage would result in a Saudi Riyal 16 million change in the fair value of these securities as at 31 December 2024.

10.2 Investment in securities of a social media services company

As at 31 December 2024, the Group holds a position in equity securities of a privately held social media services company (‘Tech Company’) amounting to Saudi Riyals 985 million (USD 262.7 million). Given the absence of quoted market prices, the fair value measurement is classified within Level 3 of the IFRS 13 fair value hierarchy, relying significantly on unobservable inputs.

Management determined fair value primarily based on recent observable private transactions involving independent, knowledgeable, and willing market participants. Specifically, the Group referenced recent transactions executed by the majority shareholder of the Tech Company, including an additional equity investment of Saudi Riyals 562.5 million (USD 150 million) at a transaction price approximating the carrying value as at 31 December 2024. Furthermore, the majority shareholder has expressed willingness to acquire additional minority stakes at the same transaction price.

Based on these factors, management concluded that observable market evidence supports the carrying value as representative of fair value. Given the active interest of a market participant to transact at this price, management deemed no adjustments for liquidity or minority discounts necessary.

Sensitivity analysis indicates that a hypothetical 5% discount adjustment would impact fair value by approximately Saudi Riyals 50 million. Management believes the assumptions and valuations employed are reasonable and align with prevailing market practices for similar privately held minority investments.

10.3 Addition to investment at FVOCI – North America (Level 3 Category)

During the year ended 31 December 2024, the Group invested Saudi Riyals 3 billion (USD 800 million) in xAI, a North America-based artificial intelligence company. This investment was part of xAI’s Series B and Series C funding rounds, each of which raised Saudi Riyals 22.5 billion (USD 6 billion), amounting to total proceeds of Saudi Riyals 45 billion (USD 12 billion).

The Series C funding round concluded on 23 December 2024, valuing xAI at SAR 169 billion (USD 45 billion) and establishing a fair valuation of the Group’s stake in xAI at SAR 4.2 billion as of 31 December 2024. Management has assessed that this recent funding round represents the relevant fair valuation for the Group’s investment in xAI at the reporting date.

11 Equity-Accounted Investees

(a) The movement in investments in equity-accounted investees for the years ended 31 December is as follows:

| 2024 |

2023 |

|

| 1 January | 17,172,435 | 16,371,058 |

| Additions (Note 11.1) | 233,050 | – |

| Dividends | (469,606) | (437,647) |

| Share of results | 1,209,032 | 1,032,833 |

| Share in other comprehensive income | 37,993 | 107,207 |

| Reversal of impairment | 200,000 | – |

| Unrealized exchange (loss)/gain on translation | (186,207) | 98,984 |

| 31 December | 18,196,697 | 17,172,435 |

Details of equity-accounted investees at 31 December are summarized as follows:

|

2024 |

2023 |

|||

| Investee name |

Effective ownership % |

Amount |

Effective ownership % |

Amount |

| BSF – Note 3 | 16.2 | 7,676,049 | 16.2 | 7,283,425 |

| Four Seasons Holding Inc (‘FSH Inc.’) | 23.75 | 2,757,939 | 23.75 | 2,452,216 |

| Accor S.A. (‘Accor’) (Note 3) | 6.8 | 2,939,753 | 6.3 | 3,002,262 |

| Jeddah Economic Company (‘JEC’) | 35.74 | 2,487,831 | 33.4 | 2,687,168 |

| Flynas Company (“Flynas”) | 37.1 | 2,049,350 | 37.1 | 1,694,639 |

| East Shura III Company | 50 | 233,050 | – | – |

| Others | 30.0-35.0 | 52,725 | 30.0-35.0 | 52,725 |

| 18,196,697 | 17,172,435 | |||

11.1 During the year ended, the Group contributed Saudi Riyals 233 million in cash for the joint venture associated with the development of Shura Island resort.

Following is the summary financial information for the equity-accounted investments:

The summarized financial information below represents amounts shown in the equity-accounted investee’s financial statements prepared in accordance with IFRS as applicable to the relevant jurisdiction.

| 31 December 2024 (All amounts in Saudi Riyals millions) |

NAS Holding Company |

Flynas |

East Shura III |

JEC |

FSH Inc. |

BSF |

Accor S.A. |

| Non-current assets | 19 | 11,108 | 899 | 11,253 | 11,416 | 88,608 | 35,457 |

| Current assets | 58 | 2,096 | 445 | 898 | 3,607 | 204,168 | 11,589 |

| Non-current liabilities | (39) | (9,265) | (721) | (3,904) | (4,229) | (431,287) | (14,711) |

| Current liabilities | (258) | (2,300) | (152) | (851) | (885) | 185,118 | (11,000) |

| Equity | (220) | (1,639) | 471 | 7,396 | 9,909 | 46,607 | 21,335 |

| KHC’s share | (82) | (608) | – | 2,643 | 2,353 | 7,550 | 1,451 |

| Carrying amount | – | 2,049 | 233 | 2,488 | 2,765 | 7,676 | 2,940 |

| Revenue | 3,223 | 4,337 | – | – | 2,507 | 16,372 | 22,744 |

| Net profit/(loss) | 185 | 253 | 4 | (558) | 1,412 | 4,544 | 2,665 |

| Other comprehensive (loss)/income | (8) | (12) | – | – | (96) | 290 | 316 |

| Total comprehensive income/(loss) | 177 | 241 | 4 | (558) | 1,316 | 4,834 | 2,981 |

| Share in total comprehensive income/(loss) | 66 | 90 | 2 | (199) | 313 | 783 | 203 |

| 31 December 2023 (All amounts in Saudi Riyals millions) |

NAS Holding Company |

Flynas |

East Shura III |

JEC |

FSH Inc. |

BSF |

Accor S.A. |

| Non-current assets | 9,657 | – | – | 11,228 | 10,434 | 73,992 | 34,747 |

| Current assets | 1,882 | – | – | 1,129 | 3,181 | 179,391 | 11,511 |

| Non-current liabilities | (9,196) | – | – | (3,563) | (4,218) | (40,053) | (12,599) |

| Current liabilities | (3,437) | – | – | (841) | (795) | (172,209) | (11,676) |

| Equity | (1,094) | – | – | 7,953 | 8,602 | 41,121 | 21,983 |

| KHC’s share | (406) | – | – | 2,656 | 2,043 | 6,662 | 1,385 |

| Carrying amount | 1,695 | – | – | 2,687 | 2,452 | 7,283 | 3,002 |

| Revenue | 6,360 | – | – | – | 2,274 | 14,710 | 20,510 |

| Net profit/(loss) | 363 | – | – | (128) | 381 | 4,223 | 2,637 |

| Other comprehensive (loss)/income | (14) | – | – | – | 32 | 667 | (49) |

| Total comprehensive income/(loss) | 349 | – | – | (128) | 413 | 4,890 | 2,588 |

| Share in total comprehensive income/(loss) | 129 | – | – | (43) | 98 | 792 | 163 |

Among the equity-accounted investees mentioned above, BSF and Accor are listed entities. At 31 December 2024, the fair value of the Group’s holding in these associates as per quoted prices amounts to Saudi Riyals 6,415 million (2023: Saudi Riyals 7,352 million) and Saudi Riyals 3,028 million (2023: Saudi Riyals 2,362 million), respectively.

Accor

For the year ended 31 December 2024, Accor reported strong financial performance, with EBITDA increasing to SAR 4.4 billion (2023: SAR 4.0 billion). Revenue grew by 11%, while net profit increased by 1% compared to the previous year. Accor also distributed SAR 1.2 billion in dividends during the year (2023: SAR 1.2 billion).

As at 31 December 2024, the Group did not identify any impairment indicators requiring an impairment assessment of its investment in Accor. However, as part of its ongoing monitoring, the Group conducted a value-in-use assessment using a discounted cash flow model over a 10-year period, which management considers appropriate given Accor’s diversified global presence and the investment lifecycle within the hospitality sector. The assessment indicated sufficient headroom, supporting the recoverability of the investment’s carrying value.

NAS

Previously, the Group held an indirect 37.1% equity stake in Flynas through its investment in NAS Holding, which owned 100% of Flynas. As of 31 December 2024, the ownership structure was reorganized, resulting in a direct transfer of the Group’s stake from NAS Holding to Flynas. Following this restructuring, the Group now holds a direct 37.1% equity stake in Flynas. The transaction was recorded at the net book value of the investment as carried in the Group’s books, with no gain or loss recognized.

The Group’s remaining investment in NAS continues to be carried at its existing value, primarily representing its services of charter and leased flights. No indicators of impairment were identified for NAS, excluding its former Flynas operations, which are discussed below.

Flynas

During 2024, NAS recorded strong topline growth. The revenue for NAS increased by 19% to reach Saudi Riyals 7.6billion (2023: Saudi Riyals 6.4 billion) for the year ended 31 December 2024. NAS also recorded a net profit of Saudi Riyals 438 million (2023: profit of Saudi Riyals 363 million) for the year ended 31 December 2024. The strong financial performance was underpinned by increase in fleet size to 70 aircrafts (2023: 64 aircrafts); increase in passengers by 31.6% to 14.7 million (2023: 11.1 million passengers) and launch of 14 new destinations in 2024 (40 new destinations in 2023).

In light of Flynas’s strong financial performance, the Group reassessed the recoverable amount of investment. The impairment assessment model indicated that the recoverable amount exceeded the carrying value, supporting a reversal of previously recognized impairment. As a result, the Group reversed an impairment loss of Saudi Riyals 200 million (2023: Nil) that had been recorded in prior years.

JEC

On October 2, 2024, JEC entered into a construction contract with Saudi Binladin Group (SBG) to re-engage SBG for the completion of the JEC Tower project. Under this agreement, construction is expected to be completed within 42 months at a revised contract value of Saudi Riyals 7.2 billion, which includes Saudi Riyals 1.059 billion previously paid for completed work.

On the same date, JEC also entered into a Final Amendment and Settlement Agreement (the “New Agreement”) with its existing shareholders and SBG. As per the New Agreement, the existing shareholders will initiate the necessary formalities to register SBG as a shareholder of JEC with a 10.66% ownership stake. However, the shares issued to SBG will not carry any economic benefits or variable interest in JEC until specific conditions are met, including but not limited to the completion, testing, and pre-commissioning of the JEC Tower project.

As at 31 December 2024, the Group has accounted for its investment in JEC based on the new Agreement with an effective ownership interest of 35.74%, reflecting the expected dilution. The Group believes that the conditions outlined in the New Agreement are administrative in nature and do not materially impact its economic interest in JEC at this stage. However, it will continue to assess the New Agreement’s conditions and any developments that may affect the accounting treatment, including potential changes in control or economic entitlement.

These new agreements supersede all previous arrangements between SBG, the existing shareholders, and the Group, rendering any prior obligations or outstanding amounts null and void.

BSF

As of 31 December 2024, the market price of KHC’s share of investment in BSF was below the carrying value, which was considered as a potential impairment indicator. The management believes that this decrease in market price is primarily due to the bonus share issuance, and is a temporary impact. Considering BSF’s strong long-term financial and operational performance, management believes there are no underlying issues with BSF’s financial health.

FSH

FSH continue to demonstrate strong topline growth and has been consistently profitable. As such the management of the Group did not identify any triggers for assessment of impairment and accordingly no impairment assessment was performed for the year ended 31 December 2024.

East Shura III Company

During the year ended, the Group contributed Saudi Riyals 233 million in cash for the joint venture associated with the development of Shura Island resort.

12 Investment Properties

| 2024 |

Land |

Buildings |

Furniture, Fixtures and others |

Total |

| Cost | ||||

| 1 January | 2,951,821 | 1,611,065 | 21,047 | 4,583,933 |

| Additions | – | – | – | – |

| Disposals (Note 12.5) | (765,811) | (91,432) | – | (857,243) |

| 31 December | 2,186,010 | 1,519,633 | 21,047 | 3,726,690 |

| Accumulated depreciation | ||||

| 1 January | – | 565,733 | 20,678 | 586,411 |

| Charge for the year | – | 15,167 | 126 | 15,293 |

| 31 December | – | 580,900 | 20,804 | 601,704 |

| Net book value | 2,186,010 | 938,733 | 243 | 3,124,986 |

| 2023 |

Land |

Buildings |

Furniture, Fixtures and others |

Total |

| Cost | ||||

| 1 January | 3,250,684 | 963,424 | 21,047 | 4,235,155 |

| Additions (Note 12.2) | – | 647,641 | – | 647,641 |

| Disposals (Note 12.2) | (298,863) | – | – | (298,863) |

| 31 December | 2,951,821 | 1,611,065 | 21,047 | 4,583,933 |

| Accumulated depreciation | ||||

| 1 January | – | 540,548 | 17,917 | 558,465 |

| Charge for the year | – | 25,185 | 2,761 | 27,946 |

| 31 December | – | 565,733 | 20,678 | 586,411 |

| Net book value | 2,951,821 | 1,045,332 | 369 | 3,997,522 |

12.1 During the year ended 31 December 2021, the Group disposed of land for a total sale consideration of Saudi Riyals 1.5 billion (present value: Saudi Riyals 1.25 billion. Also see Note 7). The sale proceeds were structured to be received in cash over a five-year period. The transaction resulted in a net gain of Saudi Riyals 502 million, after discounting the sale proceeds to present value and deducting related sales expenses, including real estate taxes and sales commissions.

In July 2024, the outstanding long-term receivable balance of Saudi Riyals 1.3 billion, due from the third party, was fully settled in cash. Until settlement, the Group recognized finance income of Saudi Riyals 47 million in 2024 (2023: Saudi Riyals 87 million) using the effective interest rate method. This amount was recorded in the consolidated statement of income under ‘Finance Income’. The difference between the carrying value of the receivable and the consideration received was not considered material.

12.2 Investment properties – Development and Sale of Riyadh land

On 6 July 2020, the Group, through its local subsidiaries, entered into an agreement (the “Agreement”) with Hamad and Ahmed Mohammed Al-Muzaini Real Estate Company (the “Second Party”) for development of a designated parcel of land totaling 4,103,561 Square Meters (‘SQM’).

The land for the project was divided into different sections, with specific areas allocated for residential units, commercial units, and services. The allocation of SQM for each plot of land was as follows:

| Division |

SQM |

| Residential | 1,408,619 |

| Commercial | 1,053,620 |

| Services | 1,641,322 |

| 4,103,561 |

It was agreed under the Agreement that the Second party will be entitled to ownership of land area designated for residential units i.e. 1,408,619 SQM, as a consideration of development activity carried out on the entire land parcel of 4,103,561 SQM.

Development on such land was completed during the year ended 31 December 2023. As at 31 December 2023, the Group has completed transfer of legal title for all the residential units measuring 1,408,619 SQM.

The Group has accounted for derecognition of residential land as consideration-in-kind for development/construction activity carried out by the Second Party on the remaining parcel of land designated for commercial and services area. The related development activity on the commercial and services area has been capitalized under ‘Investment Property” in the statement of financial position at fair value of the consideration given up amounting to Saudi Riyals 553 million. The difference in the fair value of Saudi Riyals 553 million and carrying value of Saudi Riyals 299 million of the residential land has been recognized under “Other gains, net” in the consolidated statement of income for the year ended 31 December 2023.

The capitalization of development cost of Saudi Riyals 553 million is considered as non-cash investing activity for the purpose of statement of cash flow for the year ended 31 December 2023.

12.3 Certain investment properties have been collateralized against term loans (Note 16).

12.4 As at 31 December 2024, investment properties kept for the purpose of rental yields amounted to Saudi Riyals 1 billion (2023: Saudi Riyals 1.2 billion). The direct attributable expenses associated with the rental income amounts to Saudi Riyals 184 million (2023: Saudi Riyals 210 million) for the year ended 31 December 2024. Rental agreements for these properties are for a maximum period of one year.